Can you improve your investments?

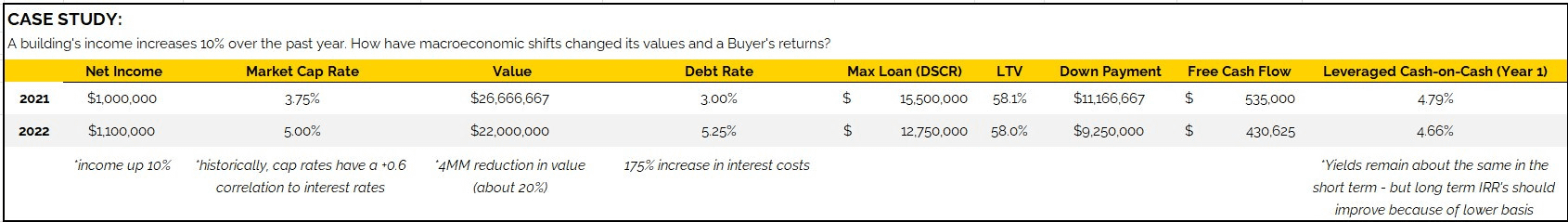

If you were buying an apartment building earlier this year, you might have borrowed money at 3.0%. Today, you can expect to pay over 5.25% for multifamily debt, maybe even more.

So what does that mean for values? It means they go down. (all else equal)

In many areas rent has been going up, which has helped offset this decline in value, but most properties are worth less today than they were six months ago. Supply of properties for sale is low, because many Sellers are taking a “wait and see” approach, hoping values will rebound. This scarcity of inventory is also temporarily propping up values.

Is now a good time to invest? On a case by case basis, yes.

Some property owners (particularly ones with construction loans that are due, or floating rate debt) cannot refinance their existing loans. For example – a property with a $1,000,000 net operating income could have qualified for a $15,000,000 loan earlier this year. Now, that same property would be lucky to get $12,000,000 in debt. If that $15mm loan is due, that owner now has to come up with $3mm in new equity, or sell.

So what do we think this means?

Here is our thesis:

1- Sellers: The peak of values is behind us. If you need to sell, the best time to do so would have been six months ago. The second-best time is probably right now. Otherwise, you may need to hold your asset for a few years for inflation to drive values back to where they were.

2- Buyers: Unique, opportunistic buying opportunities will present themselves if you search hard enough. It’s a confusing time for the market right now, and confusion can create opportunities for the resourceful.

If you’d like a complimentary valuation analysis on your building or portfolio – reach out to us.

Alternatively, if you have an upcoming 1031 exchange, or are motivated to find special opportunities, talk to our acquisitions team to help find the best investment possible for you. Or if you’re just curious what type of properties we’re finding interesting right now, we’d be happy to talk.